"Over the last few decades, a huge portion of the rapid growth of the very highest incomes relative to the rest of us has been driven by rising executive and financial sector pay."

Ben Walsh, Business Reporter, The Huffington Post (10/22/2014)

Who are the one percent? For the nation as a whole, the top one percent of households are those with an adjusted gross income of at least $465,626. But if we're looking at the one percent within each state, the income threshold varies widely:

So what are these people's jobs? Many work in occupations that pay so well they have plenty of money available to get richer still through profitable investments. A good number work in the following occupations, listed in order of median pay:

- Orthodontists (median pay: equal or greater than $208,000 a year)

- Anesthesiologists

- Obstetricians and Gynecologists

- Oral and Maxillofacial Surgeons

- Surgeons

- Physicians and Surgeons, all other

- Internists

- Psychiatrists

- Family and General Practitioners

- Chief Executives

- Dentists/Specialists

- Pediatricians

- Nurse Anesthetists

- Dentists/General

- Computer and information Systems Managers

- Architectural and Engineering Managers

- Marketing Managers

- Petroleum Engineers

- Airline Pilots, Copilots, and Flight Engineers

- Prosthodontists (median pay: $126, 050 a year)

Source: Highest Paying Occupations in the US; Occupational Outlook Handbook Updated October 24, 2017

Chief executives are in the middle of the list, with a median income of $181,230 in 2016. However, if you want to raise tax revenue for public spending by increasing the top marginal tax rate on income, the additional contribution from CEOs would be rather modest: there are only about 223,260 in the US. A drop in the tax revenue bucket.

There weren't any financial sector occupations in the top 20 list. That's because, besides a few superstars, most financial professionals aren't all that rich. For instance, in 2016 the median pay for financial analysts was just $81,760 per year. Beats waiting on tables, but these turnips won't yield much blood.

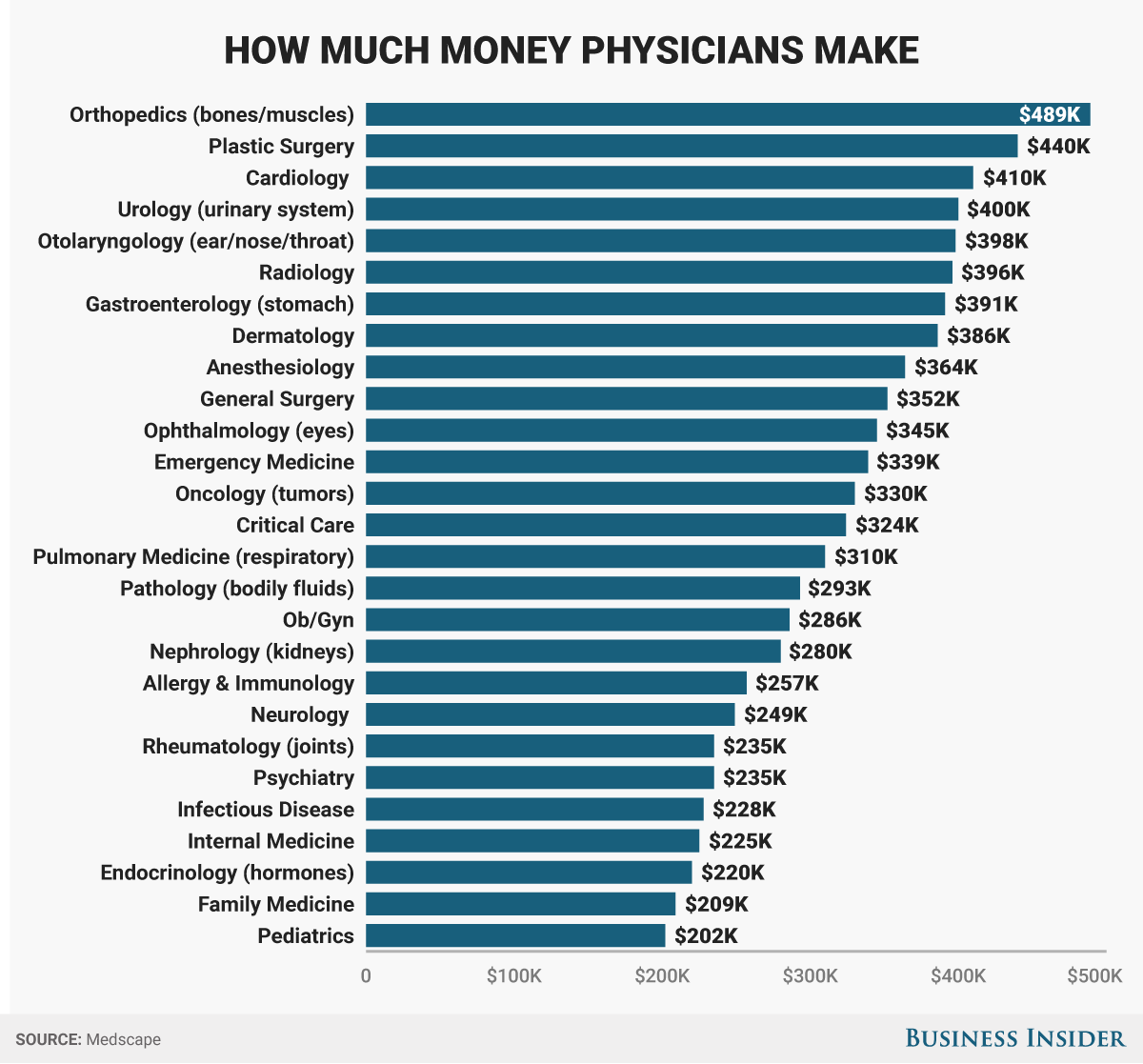

Physicians and surgeons dominate the list of top earners. The list is just a ranking though. It doesn't give us much idea of what doctors actually make, because the earnings top out at "wages equal or greater than $208,000 a year". The following chart, based on self-reported annual income from more than 19,200 doctors, provides a much clearer picture of how damn rich these medical professionals are:

Since physicians and surgeons make so much, and there are so many of them (over 700,000 in the US), it would seem a top rate tax hike would bring in a ton of revenue from this group alone. But if they paid higher taxes, government finances wouldn't benefit that much. That's because doctors could pass on much of the extra cost of earning money to their customers - especially the government, which accounts for nearly two-thirds of healthcare spending in this country. What the government taketh away in taxes it would then mostly give back through direct payments and subsidies.

The medical profession's exorbitant fees, salaries and profits are an important reason why health care costs are so expensive in the US. While raising taxes on top earners can help fund safety net programs, we could do even more for the poor and near-poor if we increased the supply of medical professionals and thereby putting downward pressure on what they can charge for their services.

Next: How to increase the supply of medical professionals and put downward pressure on what they can charge for their services.

(Updated 5/15/18)